If you work in healthcare or medical billing, understanding insurance and reimbursement terminology is essential. Every code, claim, and form plays a role in how providers get paid and patients are billed.

This comprehensive A–Z glossary covers the most important U.S. medical billing and insurance terms from everyday abbreviations to advanced reimbursement concepts—so you can navigate the billing cycle with clarity and confidence.

A — Essential “A” Terms

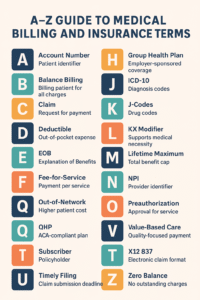

Account Number

A unique identifier assigned by a healthcare provider or billing system to track a patient’s charges, payments, and services.

Adjudication

The insurance company’s process of reviewing a claim, verifying data, and deciding payment or denial.

Allowed Amount

The maximum fee an insurance payer agrees to cover for a service, based on contractual agreements.

Appeal

A request submitted by a provider or patient asking the payer to reconsider a denied or underpaid claim.

Assignment of Benefits (AOB)

An authorization by the patient allowing the provider to receive payment directly from the insurance company.

Authorization (Preauthorization)

Prior approval required by the insurer for specific procedures or medications before services are rendered.

B — Terms in Billing

Balance Billing

When a provider bills a patient for the difference between the provider’s charge and the insurer’s allowed amount.

Note: This practice is typically prohibited for in-network providers.

Beneficiary

The individual who receives benefits under an insurance policy — often the patient.

Bundled Payment

A single, predetermined payment for all services related to a treatment or condition, rather than billing each service separately.

C — Core Terms

Capitation

A payment model where providers receive a fixed amount per patient (per month), regardless of how many services are rendered.

Claim

The formal request for payment sent to an insurance company for healthcare services provided to a patient.

Claim Adjudication

The internal review process payers use to determine whether a claim should be paid, adjusted, or denied.

Coinsurance

A cost-sharing agreement where the patient pays a percentage (e.g., 20%) and insurance pays the rest after the deductible is met.

Copayment (Copay)

A fixed dollar amount a patient pays at the time of service — for example, $25 for an office visit.

Coordination of Benefits (COB)

Determines which insurance policy pays first when a patient is covered by more than one plan.

CPT Code (Current Procedural Terminology)

Five-digit codes maintained by the AMA used to identify medical procedures and services for billing.

D —Terms in Documentation

Deductible

The amount the patient must pay out-of-pocket each year before insurance begins paying for covered services.

Denied Claim

A claim rejected by an insurer due to missing information, coding errors, or lack of coverage.

Diagnosis-Related Group (DRG)

A classification system used by Medicare to determine hospital payments for inpatient stays.

Downcoding

When an insurance company changes a submitted code to a lower-paying one, often during claim review.

E — Terms Explained

EOB (Explanation of Benefits)

A statement from the insurer explaining what was covered, what was denied, and what portion the patient owes.

Eligibility

Confirmation that a patient is actively covered under a health insurance policy.

Encounter

A documented patient interaction (e.g., office visit, telehealth call) used for billing and reporting.

Exclusions

Procedures or services not covered by an insurance policy.

F — Terms in Finance

Fee-for-Service (FFS)

A traditional payment model where providers are paid for each service performed.

Fee Schedule

A list of the maximum allowable amounts a payer reimburses for specific services.

Formulary

A list of prescription drugs covered under a health insurance plan.

Flexible Spending Account (FSA)

A pre-tax account patients can use to pay for eligible medical expenses.

G — Terms in Group Plans

Group Health Plan

Insurance coverage offered by an employer or organization to its employees or members.

Guarantor

The individual legally responsible for payment of the patient’s account — often the policyholder.

H — Terms for Healthcare Operations

HCPCS (Healthcare Common Procedure Coding System)

Codes developed by CMS used primarily for Medicare and Medicaid claims.

HIPAA (Health Insurance Portability and Accountability Act)

Federal law that protects patient privacy and ensures secure handling of health information.

HMO (Health Maintenance Organization)

A managed care plan that limits coverage to a network of doctors and facilities and requires referrals for specialists.

HRA (Health Reimbursement Arrangement)

An employer-funded account that reimburses employees for qualified healthcare expenses.

I —Terms for Insurance Insight

ICD-10-CM Codes

Diagnostic codes used to describe a patient’s condition and justify medical services billed.

In-Network Provider

A healthcare professional or facility contracted with an insurance plan to provide discounted services.

Integrity Audit

A payer or CMS review to ensure claims are accurate and comply with regulations.

Itemized Bill

A detailed invoice listing each service, code, and charge applied to a patient’s account.

J —Terms (Specialized Billing Codes)

J-Codes

HCPCS Level II codes used for billing injectable drugs and certain biologics.

K — Terms

KX Modifier

A modifier added to CPT/HCPCS codes to indicate documentation supports medical necessity (often used for therapy services).

L — Terms

Liability Insurance

Coverage that may pay for healthcare services resulting from an accident or injury for which another party is responsible.

Local Coverage Determination (LCD)

Regional Medicare policy defining which services are reasonable and necessary for coverage.

M — Terms for Medicare & More

Medicaid

Joint federal-state program providing coverage for low-income individuals and families.

Medicare

Federal insurance for individuals aged 65+ and certain younger people with disabilities.

Medigap (Medicare Supplement Insurance)

Private plans that help cover Medicare deductibles and copayments.

Modifier

A two-character code that provides additional information about a CPT or HCPCS code (e.g., -25 for separate evaluation).

MIPS (Merit-based Incentive Payment System)

CMS program linking provider reimbursement to quality and performance metrics.

N — Terms in Networks

NCD (National Coverage Determination)

Medicare policy describing whether an item or service is covered nationwide.

Network

Group of providers and facilities contracted with an insurer.

Non-Covered Services

Procedures or treatments excluded from an insurance plan.

NPI (National Provider Identifier)

A unique 10-digit number identifying healthcare providers in billing systems.

O — Terms in Operations

Observation Status

Classification for patients kept under short-term hospital observation; affects billing and reimbursement.

Out-of-Network Provider

A provider not contracted with an insurer — typically leading to higher costs for patients.

Out-of-Pocket Maximum

The total amount a patient will pay in a year before the plan covers 100% of costs.

P — Terms for Providers

Patient Responsibility

The portion of a bill the patient is obligated to pay after insurance adjustments.

Payer

The entity (usually an insurance company or government agency) responsible for claim payment.

Preauthorization

Advance approval from the payer for certain services or prescriptions.

Premium

The regular payment (monthly or yearly) to maintain active insurance coverage.

Primary Insurance

The plan that pays first when a patient has multiple coverages.

Provider

Any healthcare professional, facility, or organization delivering medical services.

PPO (Preferred Provider Organization)

A plan allowing patients to see out-of-network providers at higher costs without referrals.

Q — Terms

Qualified Health Plan (QHP)

Insurance meeting Affordable Care Act standards for essential coverage.

QMB (Qualified Medicare Beneficiary)

Medicare Savings Program that helps low-income beneficiaries pay premiums and cost-sharing.

R — Terms for Reimbursement

RBRVS (Resource-Based Relative Value Scale)

System used by Medicare to determine physician payment based on resource costs.

Referral

A written authorization from a primary care provider to see a specialist.

Remittance Advice (RA)

Document sent by payers to providers showing claim payments, adjustments, and reasons for denial.

Revenue Cycle Management (RCM)

End-to-end process of tracking patient care from registration to final payment.

S —Terms for Services

Secondary Insurance

A second policy that pays after the primary insurance processes the claim.

Self-Pay

When patients pay directly for services without using insurance.

Subscriber

The main policyholder under an insurance plan.

Superbill

An itemized form used by providers to document services for claim submission.

T — Terms in Timing

Telehealth

Delivery of healthcare services through digital communication platforms, often with specific billing modifiers and place-of-service codes.

Third-Party Payer

An organization (usually an insurer or government program) that reimburses medical expenses on behalf of the insured.

Timely Filing Limit

The deadline by which a provider must submit a claim to receive payment.

U — Terms

UB-04

The standardized claim form used by hospitals and institutional providers for billing.

Unbundling

Billing separately for services that should be billed together as a single package — considered improper billing.

V — Terms

Value-Based Care

A reimbursement model rewarding providers for quality outcomes rather than service volume.

Verification of Benefits (VOB)

Process of confirming a patient’s coverage, deductible, and copay details before treatment.

W — Terms

Write-Off

The portion of a provider’s charge that is not collected, typically due to contractual agreements or denials.

Workers’ Compensation

Insurance that covers employees injured on the job, with separate claim handling and billing rules.

X — Terms

X12 837

The standard electronic format for submitting healthcare claims.

Y — Terms

Yearly Deductible

The total deductible a patient must meet before coverage begins each plan year.

Z — Terms

Z Codes (ICD-10)

Codes used to describe factors influencing health status (e.g., screenings, preventive visits).

Zero Balance

Indicates that all charges on an account have been paid or adjusted, leaving no outstanding balance.

Key Takeaways

- Understanding billing terminology improves claim accuracy and reduces denials.

- Providers should stay updated with CMS and HIPAA requirements to maintain compliance.

- Clear communication between providers, billing staff, and payers ensures faster reimbursement and fewer rejections.

Frequently Asked Questions

1. What’s the difference between CPT and HCPCS codes?

CPT codes describe medical procedures, while HCPCS Level II codes cover supplies, equipment, and non-physician services.

2. How can providers avoid claim denials?

Verify patient eligibility, obtain authorizations, use correct coding, and submit claims within the timely filing limit.

3. What’s the role of modifiers in billing?

Modifiers add context to CPT/HCPCS codes, clarifying procedures or conditions that affect payment.

4. Why is HIPAA important in billing?

HIPAA ensures secure handling of patient data, protecting against privacy breaches and compliance penalties.